Players Making the Rules

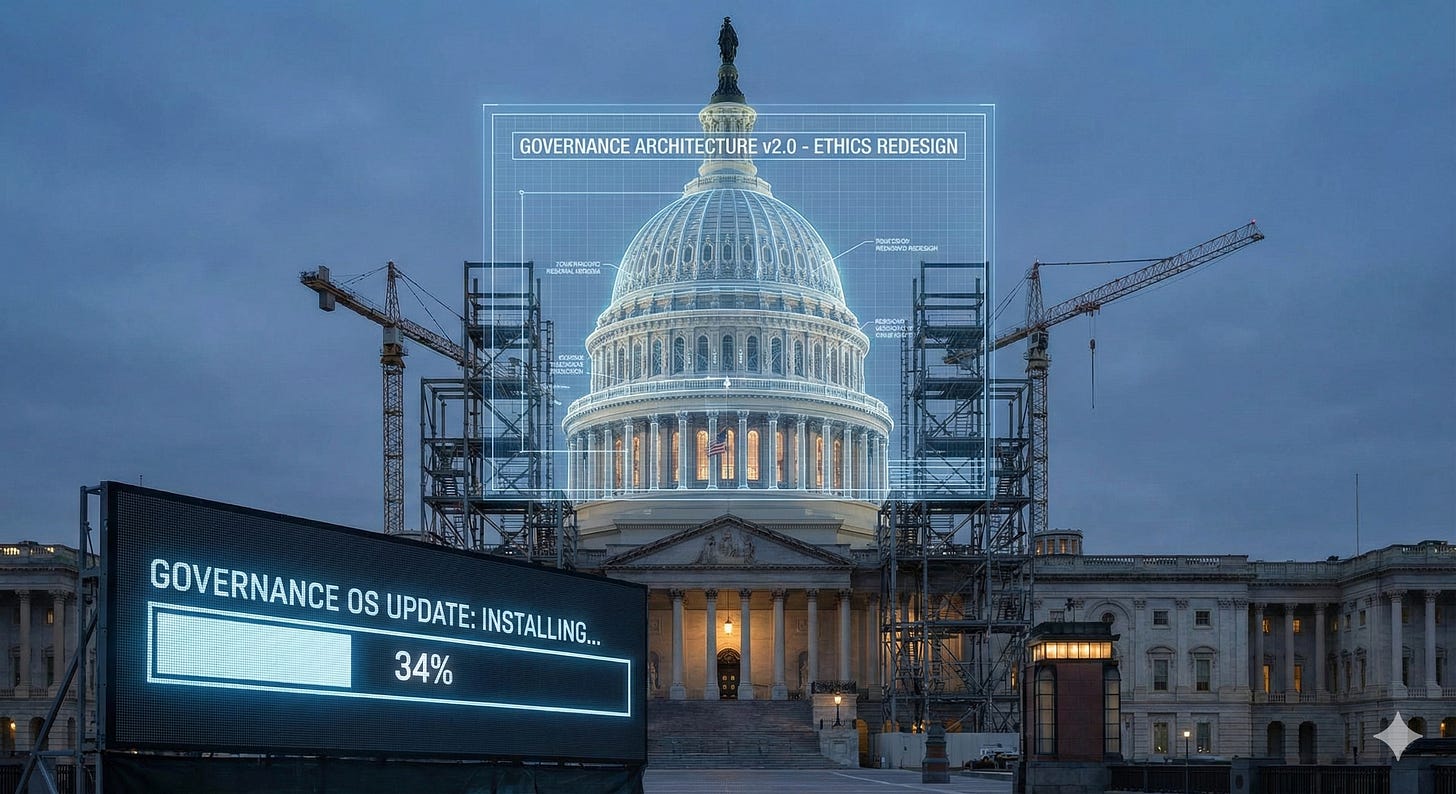

P1.5: A structural blueprint to replace the congressional honor system

Congress sets its own ethics rules. You can guess how that’s working out.

You don’t need me to catalog the abuses. We’ve been hearing about them for decades—gold bars stuffed in jackets, millions in insider trades during a pandemic, leadership PACs spent at steakhouses and resorts, 30 hours a week dialing for dollars instead of governing, members holding defense stocks while voting on wars. You’ve also heard about the reforms that keep failing—toothless disclosure laws with $200 fines, stock trading bans that never reach a vote, an FEC designed to deadlock.

What you haven’t seen is a comprehensive architecture designed as a system—the kind of design a professional governance agency would build. Here’s the overview: professionalized fundraising offices that separate candidates from the money chase, elimination of leadership PAC slush funds, an enforceable stock-trading ban with real teeth, democratized public funding that shifts who politicians respond to, and an independent enforcement body that can’t be captured by the people it regulates.

That’s the architecture. Now let me show you how each piece works.

The Architecture

What if members of Congress couldn’t personally solicit donations? What if “leadership PACs” didn’t exist? What if stock trading was actually banned—and enforced? What if there was an enforcement body that actually enforced?

None of this is fantasy. Each component exists somewhere, works somewhere. The problem isn’t that we lack good ideas. It’s that we’ve been trying to fix a system piecemeal when it needs to be redesigned as a whole.

This is exactly the kind of structural redesign a Federal Governance Agency would build—professional governance architecture instead of self-regulation by the beneficiaries of the system.

Here’s the specific design.

Component 1: Separate Candidates from Fundraising

The design is straightforward: prohibit elected federal officials from directly soliciting campaign contributions. Period. Professional campaign finance offices handle all fundraising operations. Candidates focus on governing.

This breaks the pay-to-play dynamic at its source. Right now, members of Congress spend an estimated 30 hours per week fundraising—more time than they spend on legislation, hearings, or constituent services combined.1 The party call centers are literally across the street from the Capitol, because members can’t make fundraising calls from federal buildings.2 They walk over, sit in cubicles, and dial for dollars. Four to six hours a day.3

This isn’t just inefficient. It’s corrupting. When you spend half your working hours asking wealthy donors for money, those are the people you build relationships with. Those are the people whose calls you return. The system doesn’t require explicit quid pro quo—the access itself is the corruption.

Separating candidates from fundraising changes who politicians spend time with. It removes the “telemarketer” burden that burns out good people and selects for those willing to play the game. It lets elected officials actually do the job they were elected to do.

David Jolly, a Republican congressman from Florida, proposed exactly this.4 It got about 10 co-sponsors and died in committee. We’ll come back to why.

Component 2: Eliminate Leadership PACs

Leadership PACs need to go. Not reformed. Eliminated.

Here’s what they are: separate fundraising vehicles that members of Congress can use with far looser rules than their campaign accounts. Leadership PACs are not campaign accounts—they’re loophole accounts. Campaign funds can’t be used for personal expenses. Leadership PAC funds? The rules are murky enough to drive a Mercedes through.

And members do. A 2021 report from Issue One and the Campaign Legal Center found that 120 leadership PACs spent less than 50% of their funds on anything resembling political activity.5 The rest went to resorts, steakhouses, airfare, and golf. We’re talking $2 million at hotels and resorts, $950,000 on airfare, $330,000 on golf—from leadership PACs alone, in a single two-year cycle.6

Former FEC Chairman Trevor Potter called them “political slush funds.”7 He’s being polite.

The fix is simple: apply the same personal-use prohibition that already exists for campaign funds. Leadership PACs exist as a workaround to that rule. Close the workaround. If you want to raise money for political purposes, use your campaign account with its existing restrictions.

The FEC has had a petition to do exactly this since 2018.8 Still pending.

Component 3: Ban Stock Trading—With Real Enforcement

Members of Congress trade stocks while having access to non-public information that affects those stocks. This is not a secret. It’s not even disputed. The question is whether we’re going to do anything about it.

During the early days of COVID-19, senators received classified briefings about the coming pandemic. Several of them—including Richard Burr, who sold up to $1.7 million in stocks, and Kelly Loeffler, whose portfolio saw millions in suspicious trades—made significant financial moves before the public understood what was coming.9 Burr was publicly downplaying the virus while privately dumping stock.10

The investigations went nowhere. No charges. No consequences.

This isn’t an isolated incident. According to analysis from Sludge and RepresentUs, 47 to 51 members of Congress and their spouses hold between $2 million and $6.7 million in stock in companies that are among the top 100 defense contractors.11 These same members vote on military budgets, authorize military action, and sit on committees that oversee defense spending. Since September 2001, when Congress authorized military intervention in Afghanistan, the stocks of the top five defense contractors have risen an average of 900%.12

We do have a law on the books. The STOCK Act, passed in 2012 after a 60 Minutes exposé, requires disclosure of trades.13 The penalty for violating it? $200.14 During the 117th Congress alone, 78 members violated the law.15 No charges have ever been brought against a senator or representative under the act.16

Disclosure without enforcement is theater.

Here’s what real reform looks like: a complete ban on individual stock trading for members and senior staff. Required divestiture to blind trusts or broad-based index funds. Extended post-service trading restrictions—two to five years—to prevent the “I’ll vote for this now and cash in later” problem. Criminal penalties with real teeth. Clawback provisions for any gains made during service.

This doesn’t need to be airtight to be effective. It needs to create enough friction that self-dealing seeks easier targets. Executive branch employees already face similar requirements.17 And 85% of Americans support banning congressional stock trading.18 Multiple bipartisan bills have been introduced. All have stalled.

Component 4: Realign the Funding Incentives

Right now, about 1% of Americans provide roughly 80% of all campaign donations.19 This is a structural misalignment: the funding source doesn’t match the constituency. Politicians respond to incentives. When your funding comes from a tiny slice of wealthy donors, that’s who you serve—whether you mean to or not.

To fix the architecture, we need to dilute the influence of concentrated capital with broad-based participation. Two mechanisms work in tandem: vouchers and small-donor matching.

Vouchers give every registered voter a set amount—say, $100—in “democracy dollars” that they can direct to candidates of their choice. Seattle has run this program since 2017, and the results are striking.20 Donor participation doubled from 5% to 10%.21 The number of unique donors increased 350%.22 The number of candidates running increased 86%.23 And the donor pool diversified dramatically—people of color went from less than 1% of donors to 8%.24

Small-donor matching amplifies the impact of regular people. New York City matches small donations at 8:1—a $10 contribution becomes $90.25 The result? 90% of NYC census blocks had at least one small donor to City Council races, compared to only 30% for state legislative races without matching.26 The program helped elect the first majority-women City Council in the city’s history.27

Vouchers and matching don’t eliminate big money from politics. But they create a counterweight. They give candidates a viable path that doesn’t require capturing wealthy donors. They change the math of who politicians need to keep happy.

Component 5: Independent Enforcement

None of this matters without enforcement. And right now, we don’t have enforcement.

The Federal Election Commission is designed to fail. It has six commissioners, evenly split between parties, and requires four votes to take any action.28 Any three commissioners can block anything. The result is predictable: 30% of substantive votes in 2016 ended in deadlock.29

This isn’t an accident. It’s the architecture working as designed—by the people it’s supposed to regulate.

Former Republican FEC Commissioner Don McGahn was explicit about the strategy. When accused of blocking enforcement, he said he would “plead guilty as charged” to refusing to aggressively enforce campaign finance law.30 The commission has operated without a quorum for extended periods because presidents don’t nominate commissioners and Congress doesn’t confirm them.31 Commissioners serve years past their terms.32 The agency has been deliberately starved of funding and staff.

Meanwhile, over $800 million in dark money has flowed through our elections since Citizens United, with essentially no enforcement.33

Here’s what a real enforcement body looks like: an odd number of commissioners—five or seven—to prevent automatic deadlock. Professional staff insulated from political cycles. Subpoena power and real investigative authority. Adequate funding that can’t be throttled by the people being investigated. A clear enforcement mandate, not a structure designed to fail.

Other independent agencies demonstrate this is possible. The Federal Reserve operates with significant independence from political interference. The SEC, despite its flaws, has real enforcement capability. We know how to build institutions that can actually do their jobs. We’ve just chosen not to build one for campaign finance.

Why These Must Work Together

Each of these components, implemented alone, will fail. The current system is too good at finding workarounds.

Vouchers without fundraising separation? Members still spend 30 hours a week dialing—now they’re just chasing voucher pledges along with big donations. The access corruption remains.

Stock trading ban without independent enforcement? We get another STOCK Act. Disclosure requirements with $200 fines and zero prosecutions. Theater.

Leadership PAC ban without comprehensive reform? The money flows to new vehicles. Super PACs. Dark money groups. The lawyers will find a path.

Enforcement without funding realignment? Whoever captures the enforcement body still wins. You haven’t changed who has power, just where the battlefield is.

The system must be designed as a system. That’s what governance architecture means. Each component reinforces the others. Each component closes loopholes that would otherwise swallow the rest.

Why This Architecture Works

The current system makes rational behavior corrupt behavior. If you want to keep your job, you maximize fundraising time. You cultivate relationships with big donors. You protect your ability to trade on information advantages. You preserve the loopholes that benefit you.

This isn’t about bad people. Put any reasonable person in this system and watch them adapt to its incentives—or get outcompeted by someone who will.

The redesigned system makes rational behavior accountable behavior. If you can’t solicit donations, you spend time governing. If your funding comes from broad-based small donors, you respond to broad-based concerns. If you can’t trade stocks, you don’t have financial conflicts when you vote. If there’s real enforcement, you follow the rules.

The architecture shifts selection pressure. The current system selects for fundraising ability, donor relationships, and tolerance for ethical gray areas. The redesigned system selects for governing ability, broad constituent appeal, and clean operation.

You don’t need better people. You need better architecture.

Why We Don’t Have It

The Constitution gives Congress the power to set its own rules. This made sense in 1789. But it creates a fundamental conflict of interest: the players are making the rules of the game.

Consider David Jolly’s bill. A sitting Republican congressman from Florida, he saw the problem and proposed a straightforward fix: prohibit elected officials from directly soliciting campaign contributions. Bipartisan in concept. Common sense in practice.

It got about 10 co-sponsors and died in committee.

Why? Because the people who would have to vote for it are the same people who benefit from the current system. They’ve mastered the fundraising game. They’ve built relationships with the donors. They know how to work the loopholes. Why would they change rules that got them where they are?

The same pattern repeats for every reform. Leadership PAC restrictions—pending at the FEC since 2018. Stock trading bans—multiple bipartisan bills, none brought to a vote. FEC reform—dead on arrival.

Senator Josh Hawley, a Republican, put it bluntly when discussing the stock trading ban: “They don’t want to vote against it, what they don’t want to do is to have to vote at all.”34

Here’s the elephant in the room: Congress is never going to pass this on their own.

This isn’t cynicism. It’s structural reality. You cannot expect the beneficiaries of a system to dismantle that system voluntarily. The incentives are aligned against reform. The system is working exactly as designed—for those inside it.

This has to be a demand from the people. Sustained pressure. The kind of pressure that makes NOT reforming more politically costly than reforming.

That’s why we’re building a movement.

What About Other Approaches?

Some people want a constitutional amendment to overturn Citizens United. That’s necessary but not sufficient. It doesn’t address the 30-hour fundraising week. It doesn’t close leadership PAC loopholes. It doesn’t fix stock trading conflicts. It doesn’t create enforcement capacity. An amendment addresses one problem. We need comprehensive architecture.

Some people advocate for vouchers alone. Seattle’s success is real, and I’ve cited it extensively. But vouchers by themselves don’t address outside spending, don’t fix the fundraising time sink, don’t close other loopholes. Vouchers are one tool in the toolkit, not the whole toolkit.

Some people think disclosure is enough. We tried that. The STOCK Act requires disclosure. Seventy-eight members violated it in a single Congress. Two-hundred-dollar fines. Zero prosecutions. Disclosure without enforcement is theater.

Some people say we just need to elect better people. This misunderstands the problem entirely. The system selects for these outcomes regardless of who enters. Good people either adapt to the incentives, burn out and leave, or get outcompeted by someone willing to play the game. You can’t fix a structural problem with personnel changes.

You might prefer a different design for any of these components. Fine—let’s debate which architecture to build. But we need some professional governance architecture, not the self-dealing chaos we have now.

The Bigger Picture

Congressional ethics isn’t unique. The same “players making the rules” dynamic produces dysfunction across American governance.

Government shutdowns? Congress designs the budget process that keeps failing—and they’ve exempted their own pay from the consequences.35

Gerrymandering? Legislators draw their own districts, choosing their voters instead of voters choosing them.

Debt ceiling crises? Congress created the mechanism that creates the crisis, then uses it for political leverage.

The pattern is the same. The people who operate under the rules are the same people who write the rules. And they write rules that benefit themselves.

This is why I advocate for a Federal Governance Agency—professional governance architects, insulated from political cycles, designing institutional architecture for problems exactly like this one. The FGA isn’t just another policy proposal. It’s the meta-solution that enables all other solutions.

Congress can’t reform itself. That’s not a moral failing—it’s a structural reality. And structural realities require structural solutions.

The Choice

This is what I would build. Not because it’s perfect—no design is—but because it’s a system designed as a system, not a collection of loopholes patched with more loopholes.

You might prefer different mechanisms. That’s a conversation worth having. But the current arrangement—where Congress sets its own ethics rules and we’re all shocked when they favor Congress—isn’t a real alternative. It’s learned helplessness dressed up as realism.

Here’s the thing: Congress is never going to do this on their own. Why would they? They’re winning under the current rules. The only way this changes is if we make it politically impossible for them to ignore.

That’s what this movement is about. Not hoping for better politicians. Not waiting for the system to fix itself. Building sustained citizen pressure until reform becomes the path of least resistance.

If you want to see this kind of reform, here’s what you can do:

Subscribe to follow the work. This is one piece of a larger architecture.

Share the loading symbol. The government is buffering—stuck waiting for an update we haven’t demanded yet.

Talk about this. Stop debating immigration policy, healthcare reform, gun legislation—Congress can’t pass a damn thing on any of it. The system is gridlocked by design. Help people see the pattern instead of the symptoms. The problem isn’t which party is in charge. The problem is the architecture.

We’re choosing this dysfunction. Every day we accept it, we’re choosing it. And we can make a different choice.

But only together. Only with pressure. Only if we demand it.

This is what I would build. And with enough of us demanding it, we will.

Notes

Footnotes

Issue One and 60 Minutes have documented this extensively. Former members describe spending 4-6 hours daily on fundraising calls—more time than on any other single activity. ↩

Federal law prohibits making fundraising calls from government buildings. Both parties maintain call centers within walking distance of the Capitol for this purpose. ↩

A leaked DCCC PowerPoint instructed new members to spend 4 hours on “call time” and 1 hour on “strategic outreach” daily. Ryan Grim, “Call Time For Congress Shows How Fundraising Dominates Bleak Work Life,” HuffPost, January 8, 2013. ↩

Rep. David Jolly (R-FL) introduced legislation to prohibit members of Congress from directly soliciting campaign contributions. The bill attracted about 10 co-sponsors before dying in committee. ↩

Issue One and Campaign Legal Center, “Leadership PACs: A Growing Loophole in Campaign Finance Law,” 2021. ↩

Ibid. Analysis of 2019-2020 FEC filings. ↩

Trevor Potter, former FEC Chairman, in CBS 60 Minutes interview on leadership PACs. ↩

Campaign Legal Center petition to the FEC regarding leadership PAC personal use, filed 2018, still pending as of 2025. ↩

“2020 Congressional Insider Trading Scandal,” Wikipedia, documenting trades by Senators Burr, Loeffler, Feinstein, and Inhofe following classified COVID briefings. ↩

NPR, “Justice Department Closes Investigations Of 3 Senators; Burr Inquiry Continues,” May 26, 2020. Burr publicly called COVID concerns “misinformation” while privately selling stock. ↩

Sludge and RepresentUs analysis of congressional financial disclosures and defense contractor holdings. ↩

RepresentUs, analysis of defense sector stock performance since September 2001 AUMF passage. ↩

STOCK Act (Stop Trading on Congressional Knowledge Act), signed into law April 4, 2012. ↩

Campaign Legal Center, “The STOCK Act: A Toothless Law,” analysis of enforcement mechanisms and penalties. ↩

Rep. Marie Gluesenkamp Perez (D-WA), statement on introducing bipartisan stock trading ban legislation, citing 78 violations in 117th Congress. ↩

Ballard Spahr LLP, analysis of STOCK Act enforcement history. Zero criminal charges brought against any member of Congress under the act. ↩

Executive branch employees in many positions face divestiture requirements and trading restrictions that do not apply to Congress. ↩

University of Maryland Program for Public Consultation poll, cited in NPR reporting on congressional stock trading ban proposals. ↩

Heerwig & McCabe research on campaign donor concentration; Washington State Standard analysis of donation patterns. ↩

Seattle Democracy Voucher Program, launched 2017. ↩

Washington State Standard reporting on Seattle voucher program participation rates. ↩

Journal of Public Economics, peer-reviewed study of Seattle Democracy Voucher Program effects on donor diversity. ↩

KUOW (Seattle NPR affiliate), analysis of candidate participation rates pre- and post-voucher implementation. ↩

Heerwig & McCabe, academic study of demographic shifts in donor participation under Seattle voucher program. ↩

New York City Campaign Finance Board, small donor matching program (8:1 match for contributions up to $250). ↩

Brennan Center for Justice, analysis of geographic distribution of small donors under NYC matching program vs. state races without matching. ↩

NYC Campaign Finance Board data on City Council composition following matching fund implementation. ↩

Federal Election Commission structure: 6 commissioners, no more than 3 from same party, 4 votes required for any enforcement action. ↩

FEC Commissioner Ann Ravel, “Dysfunction and Deadlock: The Enforcement Crisis at the Federal Election Commission Reveals the Unlikelihood of Draining the Swamp,” resignation report, 2017. ↩

Don McGahn, FEC Commissioner (later White House Counsel), in public statements acknowledged a deliberate strategy of narrow enforcement of campaign finance law. ↩

FEC has operated without a quorum (minimum 4 commissioners) for extended periods, most recently in late 2025 after multiple resignations and firings. ↩

FEC commissioners serve 6-year terms but routinely remain in office years past expiration due to lack of replacements. ↩

OpenSecrets, analysis of dark money spending since Citizens United v. FEC (2010). ↩

Sen. Josh Hawley (R-MO), quoted in NPR, “A Bipartisan Effort To Ban Stock Trading In Congress Has Stalled. Again,” July 10, 2024. ↩

Congressional pay is exempt from government shutdown furloughs under the 27th Amendment, though some members voluntarily forgo pay during shutdowns. ↩

What does it mean - members of congress could not trade stocks? You’re not saying categorically? Or just in reference to stocks they would have “insider” information about because of their role?